Likewise, the $20,000 of common stock in the journal entry above comes from the 20,000 shares of common stock multiplying with $1 of the par value (20,000 shares x 1$). The dividend on preferred stock is usually stated as a percentage of its par value. For example, if a corporation issues 9% preferred stock with a par value of $100, the preferred stockholder will receive a dividend of $9 (9% times $100) per share per year. If the corporation issues 10% preferred stock having a par value of $25, the stock will pay a dividend of $2.50 (10% times $25) per year. In each of these examples the par value is meaningful because it is a factor in determining the dividend amounts.

Convertible Preferred Stock Journal Entry

Par value gives the accountant a constant amount at which to record capital stock issuances in the capital stock accounts. As stated earlier, the total par value of all issued shares is generally the legal capital of the corporation. The “capital in excess of cost-treasury stock” is the same type of account as the “capital in excess of par value” that was recorded in connection with the issuance of both common and preferred stocks.

Common And Preferred Stock

Once declared, dividends become a legal obligation, and the company must record a liability on its balance sheet. This liability remains until the dividends are paid out to shareholders. The timing of this declaration and payment can significantly impact the company’s financial statements, particularly its cash flow and liquidity ratios.

Preferred Stock Features

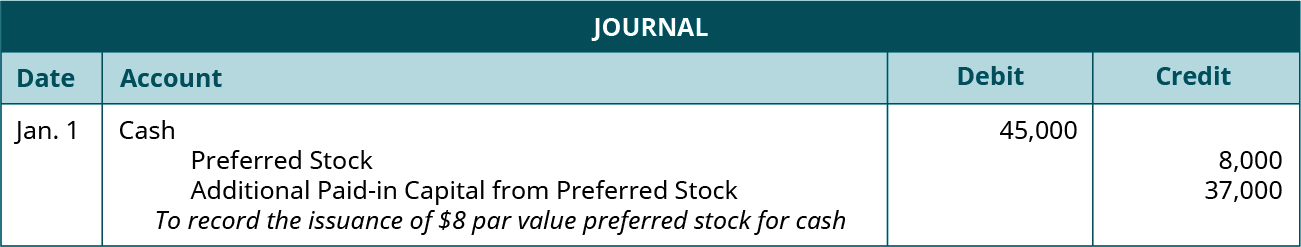

However, if the stock is participating then in addition to the above, the stockholder would receive a share of the remaining proceeds of the liquidation. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. In the event of liquidation, the holders of preferred stock must be paid off before common stock holders, but after secured debt holders. Preferred stock holders can have a broad range of voting rights, ranging from none to having control over the eventual disposition of the entity. This means that when preferred stock is sold, its par value is recorded in the Preferred Stock equity account, while the excess amount of the sale is recorded in the Additional Paid-In Capital account.

Cumulative Preferred Stock

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

Search within this section

- Understanding these types is essential for accurate accounting and financial analysis.

- For companies, issuing preferred stock can be an attractive way to raise capital without diluting control.

- The sale of equity is one of the major financing activities for a business entity, and any cash that this activity brings into the business is categorized as such while drafting a statement of cash flows.

- However, some states in USA require companies to reduce the balance of additional paid-in capital from other sources, if available.

- The potential for conversion must be factored into the calculation of diluted EPS, a metric that provides a more comprehensive view of a company’s earnings by considering all potential sources of dilution.

- When a person buys the preferred stock of a corporation, he is known as preferred stockholder of that corporation.

Another common feature of the participatory preferred stock is that it is entitled to participate in the liquidation proceeds of the company. Occasionally, a corporation may issue no-par stock, which is recorded by debiting Cash and crediting Common Stock for the issue price. Callable preferred stock gives the business the right to buy back (call) and cancel the preferred equity at some future date. To compensate the stockholder for this provision, the call price paid by the business is normally higher than the price the preferred stock was issued for.

Accounting for redeemable preferred stock involves recognizing the redemption feature and its impact on the company’s financial statements. For non-redeemable preferred stock, the focus is on the ongoing dividend payments and their effect on equity. In the above example, the business issued 1,000 7% preferred equity stock at 100 par value. Since the company may issue shares at different times and at differing amounts, its credits to the capital stock account are not uniform amounts per share. This contrasts with issuing par value shares or shares with a stated value. In some states, the entire amount received for shares without par or stated value is the amount of legal capital.

In our example, David charges the additional return to its retained earnings account, which is an acceptable treatment under all major accounting frameworks like GAAP and IFRS. However, some states in USA require companies to reduce the balance of additional paid-in capital from other sources, if available. This preferred stock feature assures the owner that any omitted dividends forms and instructions on this stock will be made up before the common stockholders will receive a dividend. Any omitted dividends on cumulative preferred stock are referred to as dividends in arrears and must be disclosed in the notes to the financial statements. When it comes to dividends and liquidation, the owners of preferred stock have preferential treatment over the owners of common stock.