However, cumulative dividends must be paid before common equity dividends or stock buybacks occur. Like bonds, preferred stocks are rated by the major credit rating companies, such as Standard & Poor’s and Moody’s. Preferred stock dividend rates are usually much higher than common stock dividend rates.

Missed Payments and Cumulative Preferred Stock

In the absence of specifications otherwise, holders of preferred stock are entitled to receive dividends in any given year only up to a stated maximum. If they fail to receive the maximum, common stockholders receive no dividends at all. If a bond issuer defaults on an interest payment, bondholders can 100 printable invoice templates sue the company, take it over and sell off its parts for cash. If a corporation is liquidated, bondholders are paid ahead of preferred shareholders. This might be a valuable feature to individuals who own large amounts of shares, but for the average investor, this voting right does not have much value.

What are preferred dividends worth?

In this situation the company establishes the dividend amount and volume for shareholders and guarantees its distribution to them. If for any reason the company cannot make the dividend payment, the outstanding dividends will accumulate over time. This is done to show the treatment of preferred dividends and the extent of dilution (the net income and outstanding shares are assumed). Within the spectrum of financial instruments, preferred stocks (or “preferreds”) occupy a unique place. Because of their characteristics, they straddle the line between stocks and bonds. If preferred shareholders want to invest in the preferred stocks, they need to look at the prospectus.

Suspending Cumulative Dividends

PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Although it’s easy enough to calculate your dividends by hand, you might prefer to use an online cumulative dividend calculator or construct a spreadsheet to handle the task for you. Their dividends come from the company’s after-tax profits and are taxable to the shareholder (unless held in a tax-advantaged account).

What Are Preferred Dividends Based on?

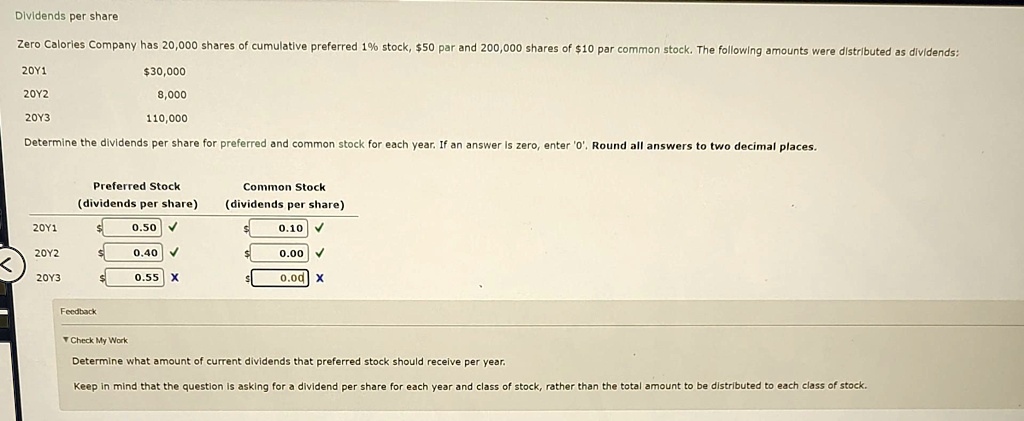

Although the use of participating preferred stock was fairly common early in the twentieth century, its use is currently confined usually to closely held companies. This shows that the cumulative dividend yield sums up the total accumulated dividends over all periods and is divided by the current share price. For example, assume the company issued 100,000 shares of common stock. You can also find the par value of the preferred stock in the prospectus for the preferred stock.

- There are a number of strong companies in stable industries that issue preferred stocks that pay dividends above investment-grade bonds.

- Annual dividends are calculated as a percentage of the par value, which is the price of the preferred stock at the time it was issued.

- However, dividends are only paid when the board of directors declares them.

- Participating preferred stock—like other forms of preferred stock—takes precedence in a firm’s capital structure over common stock but ranks below debt in liquidation events.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

In the above case, a dividend will accumulate and must eventually be paid to preferred shareholders in a subsequent financial year. Since the dividend is always paid in cash, its shortage will force the company to withhold dividend payments for 2016. If a company can’t pay all dividends, claims to preferred dividends take precedence over claims to dividends that are paid on common shares. One benefit of preferred stock is that it typically pays higher dividend rates than common stock of the same company. A company declares all future preferred dividend obligations in advance, so it must allocate funds for that purpose where they accumulate in arrears.

With preferreds, if a company has a cash problem, the board of directors can decide to withhold preferred dividends. The trust indenture prevents companies from taking the same action on their corporate bonds. As with convertible bonds, preferreds can often be converted into the common stock of the issuing company.

There are a number of strong companies in stable industries that issue preferred stocks that pay dividends above investment-grade bonds. So, if you’re seeking relatively safe returns, you shouldn’t overlook the preferred stock market. Preferred dividends referred to the amount of dividend payable on the company’s preferred stock from the profits earned by the company. Preferred stockholders typically receive the right to preferential treatment regarding dividends, in exchange for the right to share in earnings in excess of issued dividend amounts.