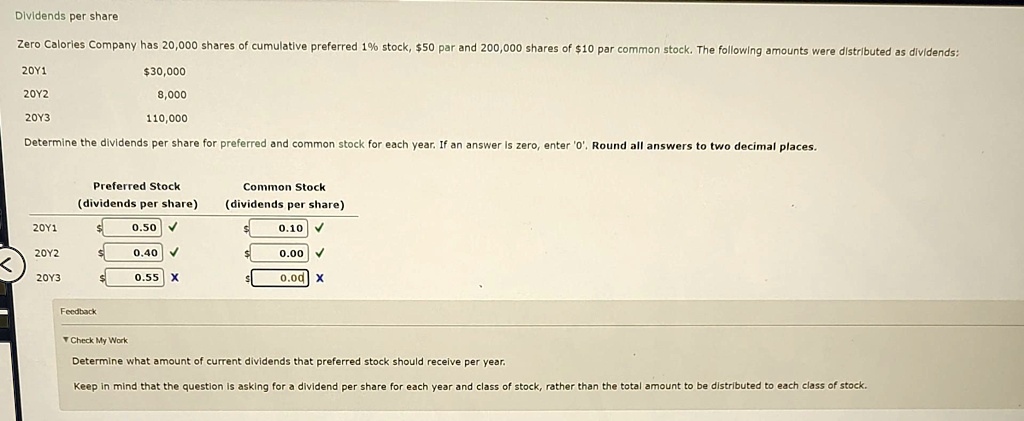

Cumulative dividends are a type of preferred dividend where any unpaid dividends from previous periods accumulate and must be paid to shareholders before common shareholders receive dividends. On the other hand, non-cumulative dividends do not accumulate; if not paid in a given period, they are forfeited. Cumulative dividends provide more security to shareholders, while non-cumulative dividends offer greater flexibility to the company. Calculating cumulative dividends per share First, determine the preferred stock’s annual dividend payment by multiplying the dividend rate by its par value. Both of these can be found in the company’s preferred stock prospectus, and par value is usually $25 or $50 per share, although there are exceptions.

How is preferred stock different from preference shares?

Preferred shares differ from common shares in that they have a preferential claim on the assets of the company. That means in the event of a bankruptcy, the preferred shareholders get paid before common shareholders. If it is assumed that convertible preferred stock will be converted within the next 10 years, the number of issuable common shares would decrease by the appropriate fraction. If the company does not declare and pay a dividend to preferred shareholders, it cannot pay a dividend to common shareholders. What happens to the preferred shareholders’ payments if the company misses a payment depends on whether their dividends are cumulative or non-cumulative.

Example of Cumulative Dividend

Over time, when there is inflation, the fixed dividend will lose purchasing power. This arrangement increases the possibility of a higher payoff and generally allows the stated preferred dividend rate to be set lower than otherwise. If your preferred stock dividends are suspended, here’s how to figure out how much you’re owed. Determine the total amount of retained earnings the company plans to pay out as dividends. For example, assume the company plans to pay out $100,000 of retained earnings as dividends.

Preference Dividends Formula

Technically, they are equity securities, but they share many characteristics with debt instruments. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Cumulative preferred stock provides a clear legal priority in the event of default. Investors must understand the distinctions among the types of dividends so that they can make informed decisions regarding their investment portfolios. Moreover companies carefully weigh the advantages and disadvantages of dividend policies when determining their steps.

You can calculate your preferred stock’s annual dividend distribution per share by multiplying the dividend rate and the par value. The total Accumulated Dividend is 180; in 2020, if the company makes a profit, it will have to clear the total accumulation of 180 + 2020 preferred dividend, then common stockholders can be paid. Preferred share dividends are normally fixed, so the shares don’t benefit from the growth of the issuing corporation. While dividends might be an attractive feature of common stock, they are virtually the only reason to purchase preferred stock. Companies must weigh the benefits of offering cumulative dividends against these drawbacks.

Preferred Dividend

- It means that if you’re a preferred shareholder, you will get a fixed percentage of dividends every year.

- True preferreds pay real dividends while trust preferreds pay interest income and are typically structured around corporate bonds.

- However, a majority of preferred-stock issuances are nonparticipating.

- Preferred dividends hold significance as they represent consistent income payments to preferred shareholders, establishing an attractive incentive for investors.

Preferred dividends typically pay a higher rate than dividends paid to common shareholders, which is one of the main benefits of these dividends. The preferred stock rates and terms are also displayed on the balance sheets of the company, while the common stock dividends are declared only after the year’s end by the board of directors. There is a lot more transparency with preferred dividends than with common stock. If a company cannot pay all of its dividends, it must pay preferred dividends before paying dividends to holders of common stock. If your preferred shares pay a 6% dividend rate and have a par value of $25, you can determine the cumulative dividends with the three steps discussed above.

It means that if you’re a preferred shareholder, you will get a fixed percentage of dividends every year. And the most valuable part of the preferred stock is that the preferred shareholders get a higher dividend rate. They are also given more preference than equity shareholders in dividend payments.

In contrast, holders of the cumulative preferred stock shares will receive all dividend payments in arrears before preferred stockholders receive a payment. Essentially, the common stockholders have to wait until all cumulative preferred dividends are paid up before they get any dividend payments again. For this reason, cumulative preferred shares often have a lower payment rate than the slightly riskier non-cumulative preferred shares. A company cannot change the dividend rate set for cumulative preferred shares when issued. However, companies can suspend cumulative dividend payments for some time due to financial difficulties. Any suspended dividends will accumulate as dividends in arrears and should be paid before common shareholders receive dividends again.

Preferred shares are anti-dilutive if the dividends saved per issuable common share exceed EPS without assuming conversion. The companies issuing shares of preferred stock can also realize some advantages. In some cases, the fixed rate of dividend payments can be a disadvantage.

The major selling point for preferred stock is its high dividend yield, usually in the 4 percent to 8 percent range. Dividend yield is the annual dividend amount divided by the share price. If a company goes belly-up and is liquidated, the proceeds what causes a tax return to be rejected go to holders of bonds, preferred shares and common shares, in that order. This means that shareholders may wind up with little or no money after the bondholders get theirs. Determine the fixed dividend rate for the participating preferred stock.

Therefore, the numerator is not adjusted for the preferred dividends that are actually paid during the part of the year in which they were outstanding. However, an individual investor looking into preferred stocks should carefully examine both their advantages and drawbacks. The starting point for research on a specific preferred is the stock’s prospectus, which you can often find online. If, for example, a pharmaceutical research company discovers an effective cure for the flu, its common stock is likely to soar, while the preferreds might only increase by a few points.